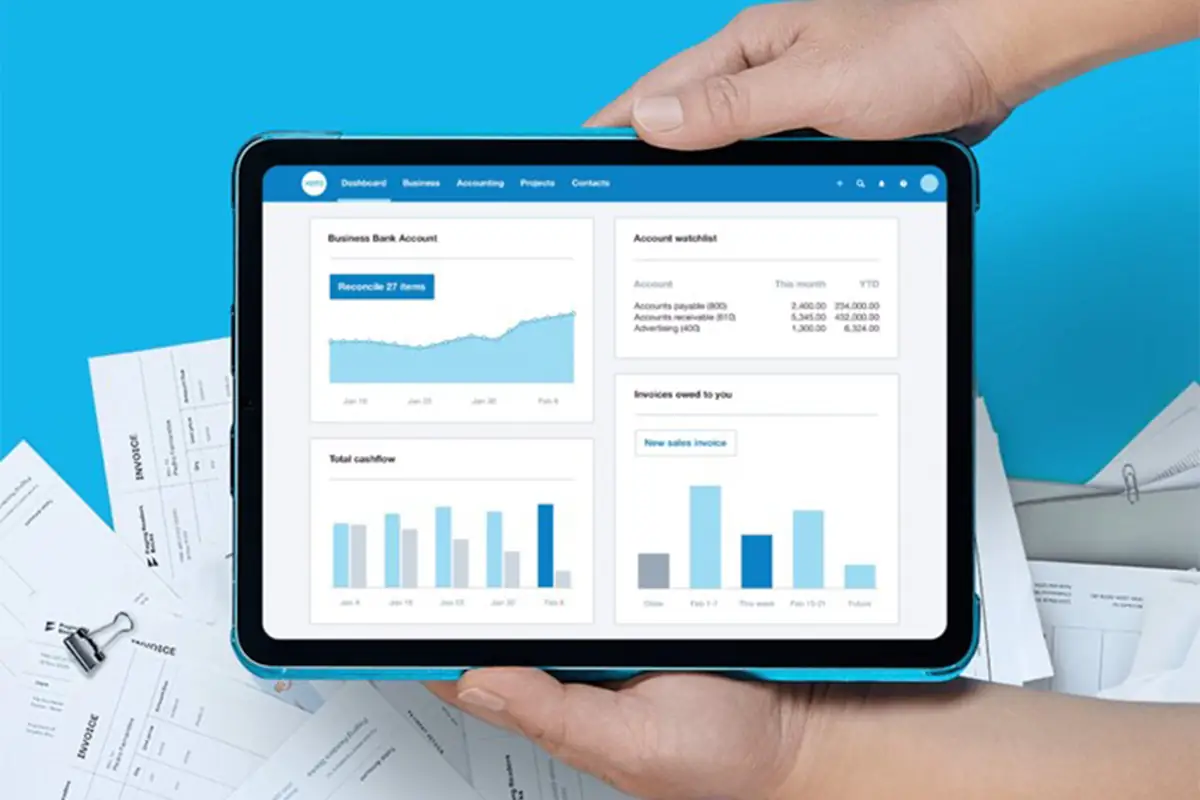

Xero has revolutionized the way small business owners manage their finances by creating an online accounting software that connects them with their numbers, bank, and advisors anytime. Created in 2006, Xero now boasts 3.7 million subscribers and is a leading provider of cloud accounting services across New Zealand, Australia, and the United Kingdom. With an experienced board, executive and leadership teams, Xero focuses on innovation and performance to provide its customers with the best service possible. Xero’s team is dedicated to helping businesses, accountants, and bookkeepers automate, collaborate, and grow. Whether you’re a small business owner or an accountant, Xero has the tools and resources you need to stay on top of your finances.

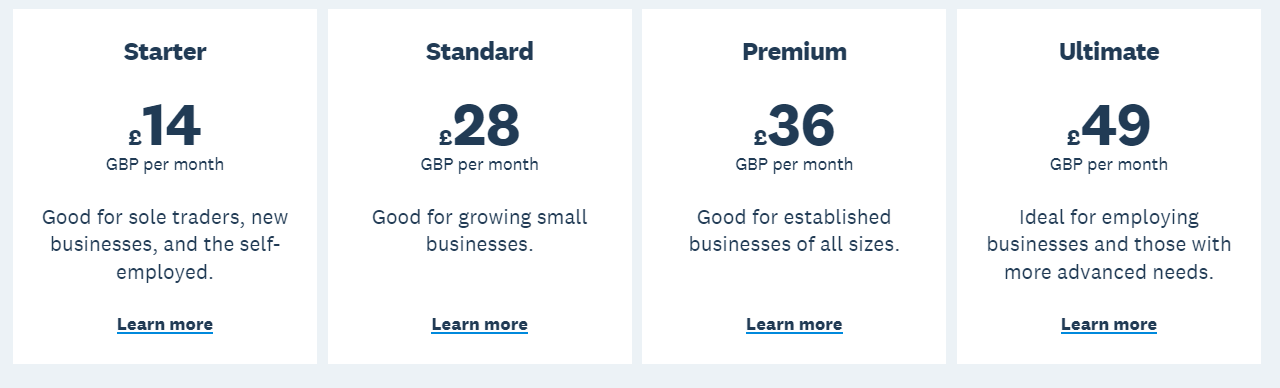

Xero Plans

Starter

Are you a sole trader, just starting your own business, or self-employed? Look no further than Xero’s Starter Plan, starting at just £14 per month. With 24/7 online support and the ability to cancel with a month’s notice, you can trust Xero to provide you with safe and secure accounting services. Plus, their plan is ready for Making Tax Digital so you can spend less time worrying about taxes and more time growing your business. With the ability to send invoices and quotes, enter bills, reconcile bank transactions, submit VAT returns to HMRC, and capture bills and receipts with Hubdoc, Xero’s Starter Plan has everything you need to succeed. And to top it off, the plan also includes automatic CIS calculations and reports, a short-term cash flow, and a business snapshot.

Standard

As a growing small business, finding a tool to manage your finances that fits both your budget and your needs can be a challenge. Luckily, Xero’s Standard plan includes a range of features to help you keep track of your finances without breaking the bank. For just £28 per month, you can send invoices and quotes, enter bills, reconcile bank transactions, and even submit VAT returns to HMRC. But that’s not all – with Hubdoc, you can easily capture bills and receipts, and Xero’s automatic CIS calculations and reports take the guesswork out of managing your construction business. Plus, with short-term cash flow and business snapshot reports, you’ll always know where your business stands financially. The Xero Standard plan has everything you need to keep things running smoothly.

Premium

Are you running a well-established business and need an accounting solution that can handle your size and scale? Look no further than Xero’s Premium plan. For only £36 GBP per month, you’ll gain access to a range of powerful features such as the ability to send invoices and quotes, enter bills, and reconcile bank transactions. Additionally, the plan allows you to submit VAT returns to HMRC and capture bills and receipts with Hubdoc. Need to work with multiple currencies? Not a problem. You can also use the plan to perform bulk reconciliations and receive automatic CIS calculations and reports. And with short-term cash flow and a business snapshot, you can quickly and easily get a handle on your financial state.

Ultimate

For businesses with more advanced needs, Xero’s Ultimate Plan is the perfect choice. This plan not only provides the necessary tools to manage payroll but also gives you the capability to claim expenses and track projects. With Analytics Plus, you can easily view reporting and data insights to make informed business decisions. Additionally, you can send invoices and quotes, reconcile bank transactions, and enter bills with ease. The Ultimate Plan also enables automatic CIS calculations and reports and submission of VAT returns to HMRC. With Hubdoc, you can capture bills and receipts automatically, and the plan offers a short-term cash flow and business snapshot. And lastly, you can work with multiple currencies easily and bulk reconcile transactions quickly saving you precious time and resources.

FAQS

Do I have to pay extra for bank feeds to use the service?

Direct bank feeds from Xero are offered at no extra cost to the vast majority of users. They will pass on to you the bank feed costs that some UK banks levy.

How many different businesses can I add on to that?

Xero allows you to add as many businesses as you like, each with its own pricing tier or a free 30-day trial. When you add a business and subscribe to a plan for it, you take on the role of the business’s subscriber. When you sign up for Xero’s Business Edition for more than one company, you’ll receive a volume discount. Both businesses must utilise the same subscriber email address in order to receive the discount. Using the same email address and the same country edition of Xero will immediately apply the discount to both businesses. Contact Xero Support to have the discount applied manually if your business uses a different national edition. A subscriber with multiple locations in different countries may need to contact Xero Support to receive the discount.

Can I pay for a year at a time?

Invoices are sent out once a month after the end of the billing cycle. Payment will be collected via the payment method and date selected at subscription purchase. If you have a chargeable direct bank feed or incurred usage fees in Xero Payroll, Xero Projects, or Xero Expenses over the previous month, you will receive an invoice for these costs.