What is Xero accounting software?

Running a business is no small feat, and handling accounting processes can often be a daunting task. Luckily, Xero accounting software was created with small businesses in mind. This cloud-based software provides an array of features and benefits that make bookkeeping simple and stress-free. With invoicing, payroll, and the ability to connect to a live bank feed, Xero takes the hassle out of managing finances. Plus, it offers both cash-based and accrual accounting systems. Since its introduction, Xero has proven to be an excellent solution for businesses of all sizes, providing users with powerful yet user-friendly tools. If you’re looking for a way to streamline your accounting processes, Xero may be the answer you’ve been searching for.

Pay your bills on time, every time

Keep an eye on things and pay your bills on schedule. Also, receive a comprehensive perspective of your accounts payable and the movement of cash.

Keep on top of bills

Check the calendar to see what bills are coming due, then pay them on time.

Schedule payments

You should make your payments in batches, and you should schedule them in advance.

Store bills in one place

You may access all of your bills and payments online from any location.

Easily submit VAT returns online

Xero uses software that is compatible with HMRC systems to perform VAT calculations and submit VAT returns to HMRC in a safe and secure online environment.

VAT calculated for you

Returns are processed with the calculated and included VAT amount.

Manage VAT transactions

You can view the specifics of the VAT transaction and make revisions to it.

File VAT returns online

Make sure your VAT returns are compatible with MTD before submitting them.

Manage expenses effortlessly

Using the capabilities provided by the expense manager, you can simply capture expense claims, track employee spending, and manage the company’s overall expenditures.

Take a photo of receipts

Make the process of claiming expenses quick and paperless.

Reimburse expenses quickly

Expense claims should be approved without any delay.

Monitor employee spending

Examine the analytics to better handle the costs.

Manage expenses on the go

Use the app to submit your expenses or keep track of your miles.

Set up bank feeds, or import bank data into Xero, and save time

You may import the data from more than 21,000 banks and other financial institutions around the world into Xero. Customers of Xero save an average of 5.5 hours per week because to the use of bank feeds and automated reconciliation.

Get bank data into Xero with bank feeds

Establishing bank feeds requires connecting your bank to Xero. Once this is done, your bank transactions will be imported into Xero automatically.

Export bank data for upload into Xero

Even if your financial institution does not currently provide direct bank feeds, it is simple to download and import transaction history.

Get an up-to-date financial picture

Make it a habit to reconcile your new bank transactions on a regular basis so that you can maintain an accurate and up-to-date picture of your financial situation.

Keep your data safe and secure

Through a safe and encrypted connection, Xero is able to import bank transactions, giving you peace of mind that your data is protected.

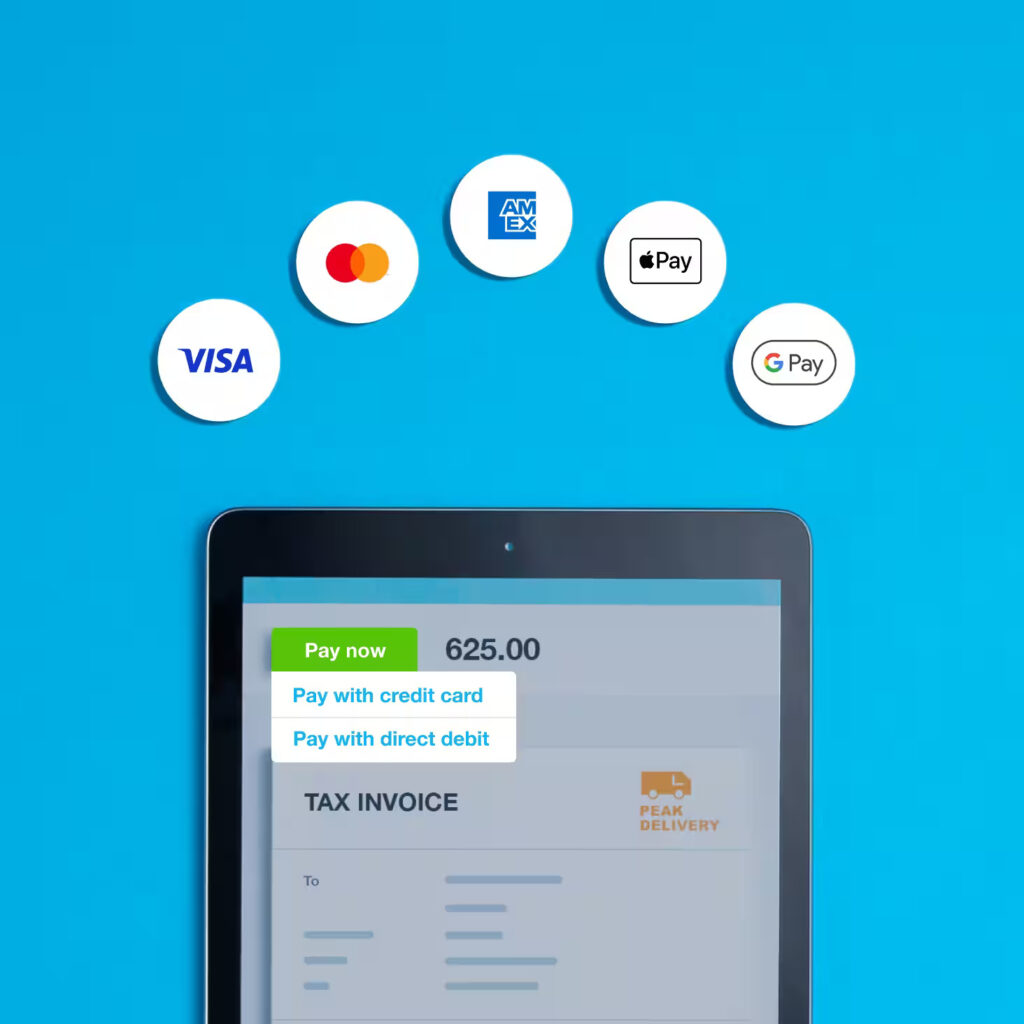

Accept online payments and give customers more ways to pay

You can accept payments directly from your Xero invoice using online payment methods like as credit cards, debit cards, and direct debit. By granting customers the option to pay however they see fit, businesses can improve their chances of being paid on time while also cutting down the amount of time spent doing so.

Free one time set-up, get started in minutes

Set up payment systems, such as Stripe or GoCardless, for free and provide your customers with more ways to pay their invoices in a timely manner.

Give customers multiple ways to pay

You can give the impression that your company is well run by providing innovative payment options such as individualised online invoicing.

Add click-to-pay to online invoices

Include a button labelled “Pay now” to make it simpler for clients to make payments to you. Fewer steps means fewer mistakes and less need to chase after lost pieces.

Payments are protected against fraud

By utilising reliable payment processing services, you may securely take payments made via credit card as well as direct debits.

Final thought

Xero accounting software has truly revolutionized the world of accounting and bookkeeping for small businesses. Its numerous features offer a competitive edge for entrepreneurs in an industry where most small businesses fail within the first few years. Easing the process of report preparation, tax submissions, and accounting, Xero is flexible enough to grow alongside the business. The best part? Accountants can have easy access to the business accounts through the software, ensuring smooth and timely submissions. Although there are other options on the market, Xero remains an easy-to-use accounting package that caters specially to small businesses.