When it comes to online bookkeeping, Xero is revolutionary. They have made it their mission since their founding in 2006 to provide cutting-edge, high-performance solutions to their clientele. Their influence has been immense, as evidenced by their 3.7 million member base throughout Australia, New Zealand, and the United Kingdom. The company’s experienced board, management, and leadership members are dedicated to providing exceptional service to each and every one of their clients.

There is no better example of how to use technology to empower small businesses than Xero, whose aim is to aid businesses, accountants, and bookkeepers in automating, collaborating, and growing. If you want to work for a company where you can make a real difference in the lives of small businesses throughout the world, Xero is the place to be.

Xero Tax for accounts and tax compliance

Xero Tax allows businesses and individuals to take command of their financial records and file their tax returns from a central location in the cloud.

Handle Tax Forms

Fill out tax forms for businesses and individuals.

Use Xero to share information

Books, finances, and tax returns all share data with one another.

Create Reports Quickly

Streamline the creation of client accounts.

Do your tax returns online.

Use Xero Tax for all of your accounting and tax filing needs.

Manage tax returns

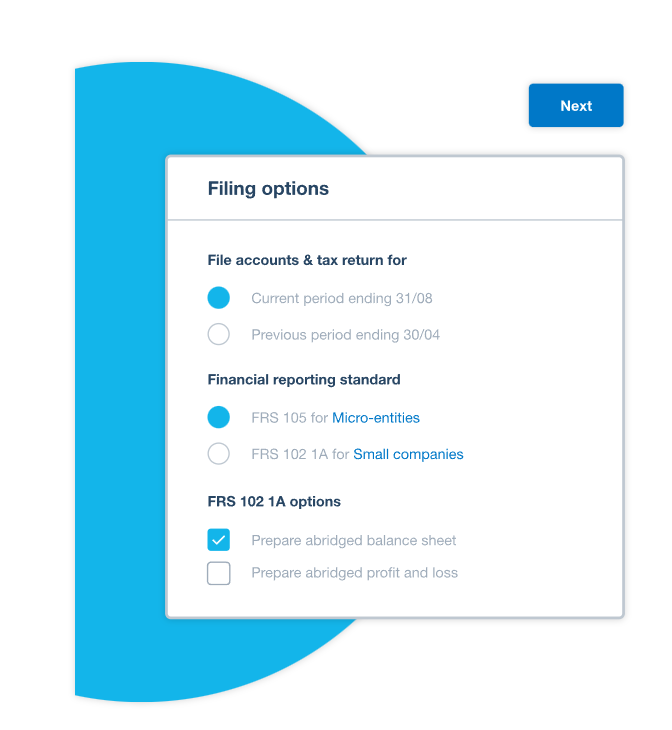

Compliance is made easier with Xero Tax since it cuts down on the amount of time needed on the preparation and submission of appropriate tax returns and accounting. Xero Tax also simplifies accounting.

- Establish a connection to the accounting information held in Xero.

- Create and submit your accounts.

- Prepare and file individual and corporate tax returns (SA100 tax return forms, as well as supplemental pages, and SA302 tax return forms, some of which are still in development).

Produce accounts easily

Streamline the preparation of accounting records for both enterprises and sole proprietorships.

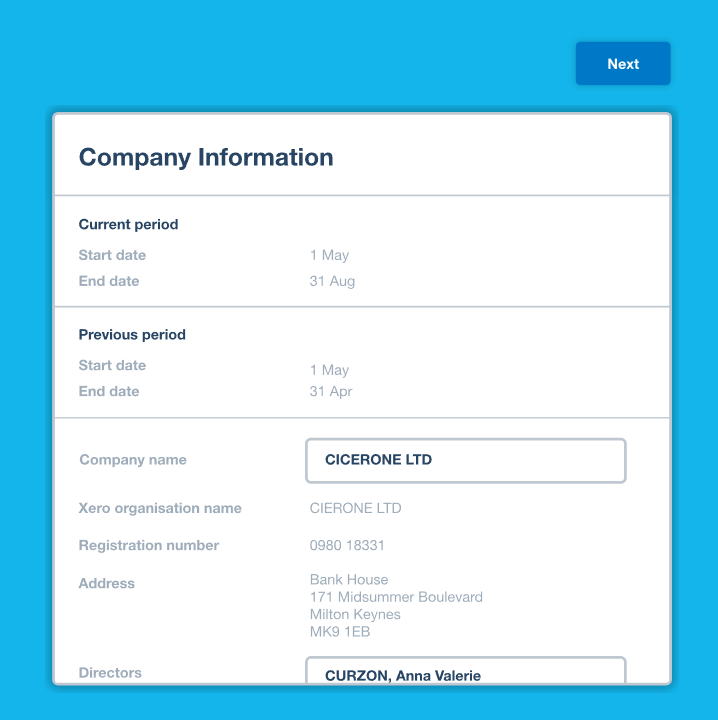

- Use Xero‘s database as a source for company and tax information.

- Compile company information from Companies House.

- Make tax returns for sole proprietors using data imported from Xero‘s financial records.

Submit returns online

Xero Tax allows you to instantly file annual accounts and tax returns for company clients as well as individual clients.

-

Submit corporate tax returns for company clients to HMRC

-

Submit personal tax returns for individual clients to HMRC

-

File company accounts with Companies House direct from Xero