Xero

Xero has certainly come a long way since its inception in 2006. With an impressive 3.7 million subscribers across New Zealand, Australia, and the United Kingdom, this cloud accounting leader is revolutionizing the way small businesses approach their finances. What sets Xero apart is their unwavering focus on innovation and performance, led by a team of experienced board members and executives. But it’s not just about the numbers; the Xero team is passionate about helping businesses, accountants, and bookkeepers automate, collaborate, and ultimately, grow. If you’re looking to join a team of talented thinkers, creators, and educators who are making a real difference in the business world, Xero just might be the perfect fit for you. With easy-to-use accounting software designed specifically for small businesses, Xero is truly reshaping the industry.

Everything in one place

As a small business owner, keeping track of finances and bookkeeping can be a daunting task. That’s where Xero comes in. With this online accounting software, everything is in one place, making running your business and staying on top of financial records a breeze. With the ability to automate tasks like invoicing and reporting, you can save time and focus on growing your business. Plus, with up-to-date financial data at your fingertips, you’ll have a full picture of your business. And come tax time, end-of-year returns will be a piece of cake with Xero’s compliance features. Stay organized and streamline your business with Xero.

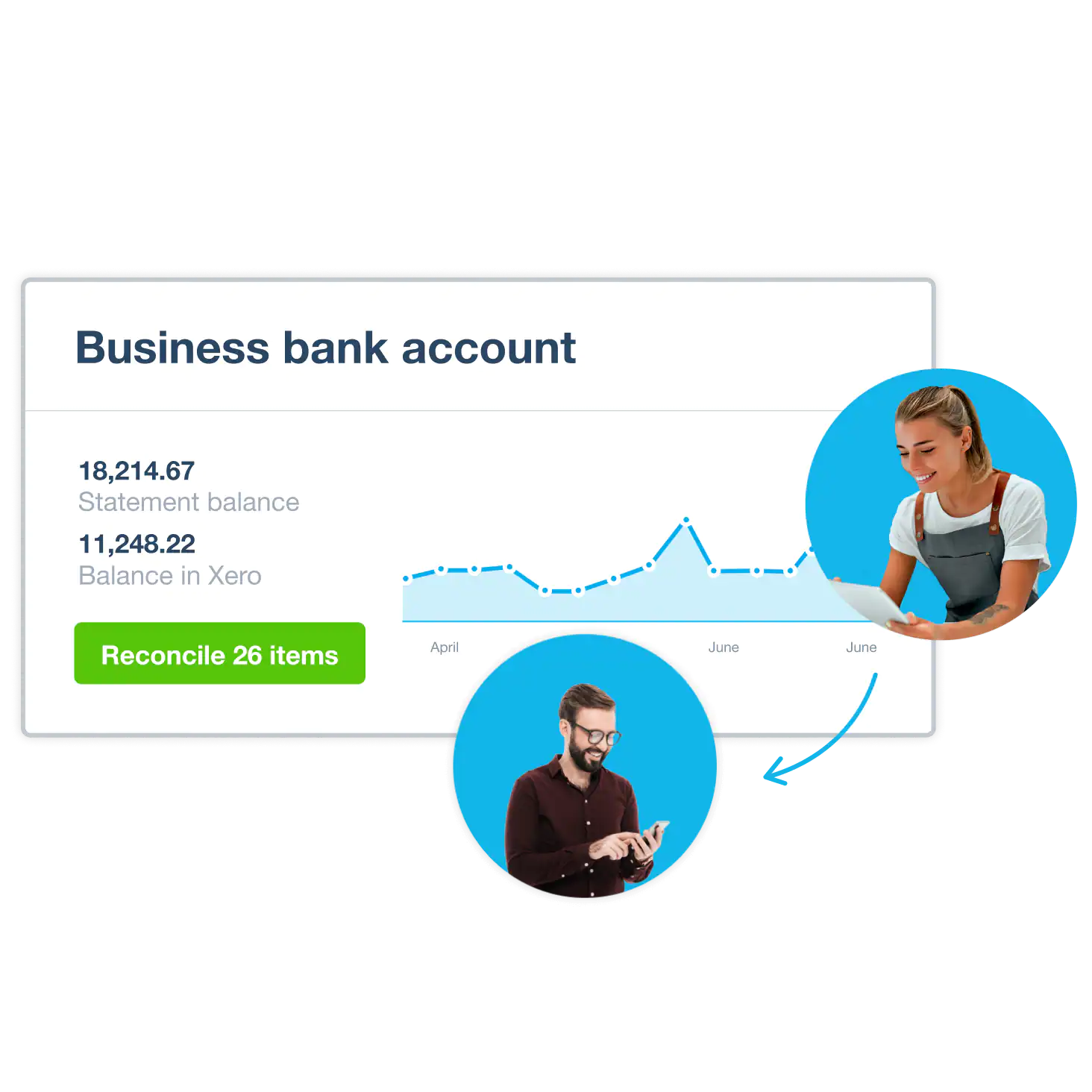

Connect to your bank

Connecting to your bank has never been easier with Xero accounting software. By setting up bank feeds from your accounts, your daily transactions are securely imported into the Xero system. This automation saves you time and energy when it comes to reconciling your bank transactions on a daily basis. With this feature, you can easily maintain an up-to-date picture of your cash flow, giving you a clear understanding of where your business stands financially. Stay on top of your finances and take the first step towards a more streamlined accounting process by connecting to your bank through Xero.

Collaborate online in real time

Working remotely has become increasingly popular over the past few years. However, collaborating with team members who are in different parts of the world can sometimes be challenging, especially when it comes to financial transactions. With Xero, this becomes a thing of the past. As an online accounting software, Xero allows you to collaborate with your bookkeeper, accountant, or employees in real time, no matter where they are. With the ability to access the same financial information simultaneously, you can work together and provide the most up-to-date information to each other. Real-time comments and discussions can be based on the most recent financial and business data available, which is essential for making informed decisions. Additionally, employees can submit expenses, manage time off, and send invoices quickly and efficiently. With Xero, distance is no longer a barrier to effective financial collaboration.

Customise to suit your needs

Running a small business can be challenging, but with Xero online accounting software, you can customise it to suit your needs. This is because the software offers various add-ons, including Xero Expenses and Xero Projects, which are designed to make it easier for you to run your business. You can also connect to third-party apps like Stripe and Vend, which offer additional features that you might find useful. To make it even better, the Xero App Store has numerous apps that you can try and buy, making it easy to find the right add-ons that will help you manage your business efficiently. With Xero, you can tailor the software to meet your unique requirements.

Moving to Xero from other accounting software

When it comes to moving your accounting software, Xero offers a solution that makes things easier for you. Thanks to the import functionality, you can import data from your old accounting software seamlessly. All it takes is a few simple steps and you can easily bring in your chart of accounts, invoices, bills, contacts, and fixed assets. One piece of advice is to work with an accountant or bookkeeper that has experience with Xero. They can offer you invaluable guidance on how to make the most of the software and ensure a smooth transition. Whether you’re a small business owner or a seasoned financial professional, Xero offers a user-friendly interface and a range of features that make accounting simpler and more efficient.

Why Choose Xero?

Are you tired of drowning in spreadsheets and struggling to keep your finances in order? It’s time to consider Xero. This cloud-based accounting software has quickly become a popular choice for its intuitive features and powerful capabilities. With Xero, you can easily track your income and expenses, sync your bank accounts, create customized invoices, and even manage your inventory. The best part? Xero is highly customizable to fit your unique business needs. With a wide range of integrations available, you can easily tailor the platform to work seamlessly with your favorite tools and software. Whether you’re a solopreneur or a large-scale business owner, Xero is the perfect solution for easy and efficient financial management.